Adhesives and Sealants Market Size Worth USD 126.50 Bn by 2034 Driven by Green Construction and Automotive Trends

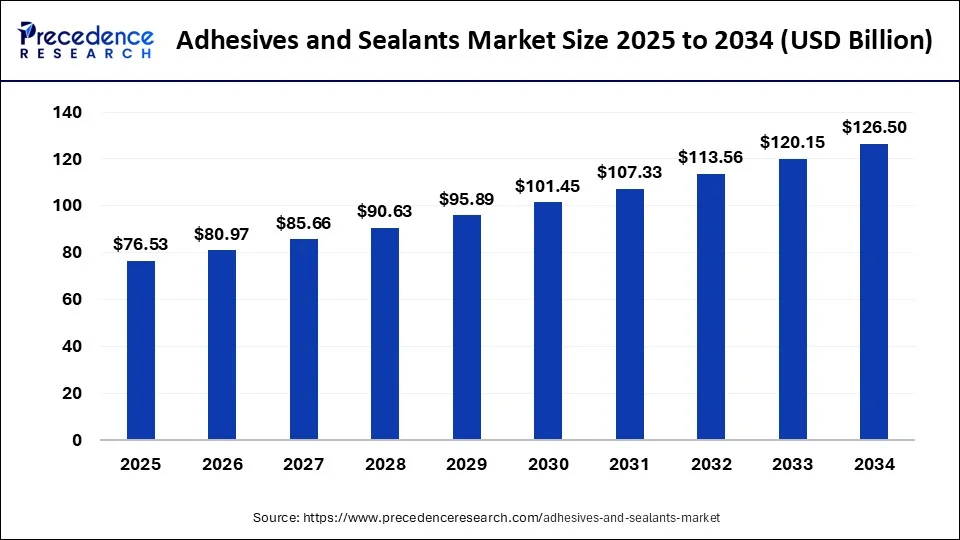

The global adhesives and sealants market size is expected to be worth USD 126.50 billion by 2034, increasing from USD 76.53 billion in 2025 and is growing at a CAGR of 5.75% from 2025 to 2034, fueled by green construction, EV adoption, and packaging innovations.

Ottawa, Aug. 01, 2025 (GLOBE NEWSWIRE) -- According to Precedence Research, the global adhesives and sealants market size accounted for USD 80.97 billion in 2026 and is projected to reach approximately USD 126.50 billion by 2034. Key growth drivers include rapid urbanization, demand for sustainable construction, EV production, and packaging innovations. Asia Pacific leads the global market, while water-based and reactive adhesive technologies dominate adoption trends.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/1141

Adhesives and Sealants Market - Key Takeaways

- The global adhesives and sealants market size was estimated at USD 72.33 billion in 2024.

- It is projected to hit USD 126.5 billion by 2034.

- The market is growing at a CAGR of 5.75% from 2025 to 2034.

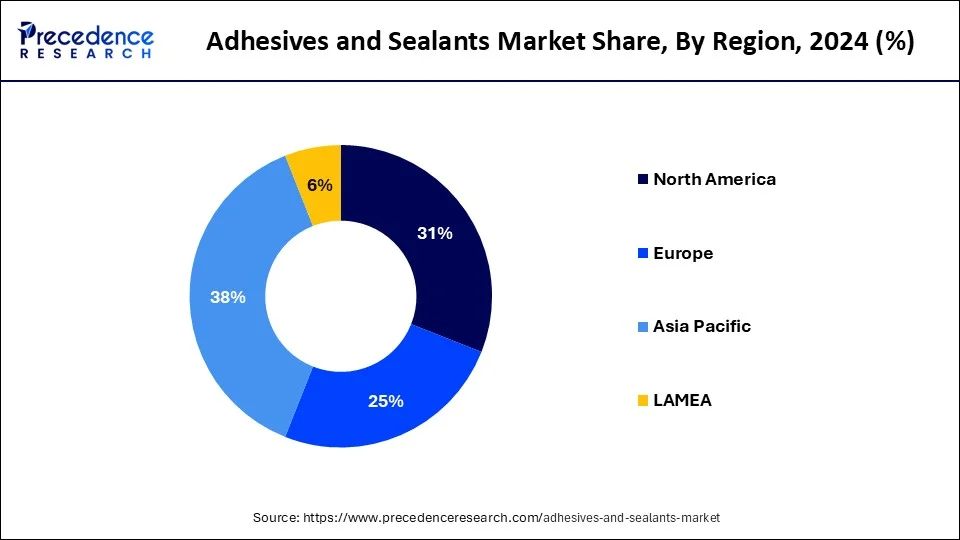

- Asia Pacific accounted for the largest market share of 38% in 2024.

- By technology, the reactive and others segment contributed the highest market share of 48.4% in 2024.

- By product, the silicones segment held the major market share of 31.5% in 2024.

- By application, the paper and packaging segment captured the highest market share of 30% in 2024.

Talk to an Expert Analyst Today: sales@precedenceresearch.com

Adhesives and Sealants Market Overview

What are Adhesives and Sealants?

Adhesives are materials used to create a strong bond between surfaces, and sealants are developed to fill joints and gaps. Adhesives are developed using materials like polyurethane, cyanoacrylate, epoxy, silicone, & many more, while sealants are developed using materials like PU, acrylic, PVA, & silicone. The characteristics of adhesives are temperature resistance, bonding strength, chemical resistance, and curing time.

The characteristics of sealants are weather resistance and flexibility. Adhesives are used to bond various materials like metals, composites, plastics, & ceramics, while sealants are used in plumbing, weatherproofing, and joint sealing. Adhesives & sealants are used across various industries like electronics, construction, packaging, consumer goods, aerospace, and automotive.

"Sustainability and smart infrastructure projects are transforming adhesive technologies, especially across Asia Pacific," said Saurabh Bidwai, Lead Researcher at Precedence Research.

Major Types of Adhesives & Sealants:

| Adhesives Type | Sealants Type |

| Epoxy Adhesive:- It consists of hardener and resins. It is highly resistant to temperatures & chemicals and is durable. Epoxy adhesives are widely used in aerospace, metal bonding, and ceramics & concrete. | Silicone Sealant:- It is a flexible sealant that has excellent extreme temperature resistance. It is widely used in applications like bathroom fixtures, windows, and doors. |

| Cyanoacrylate Adhesive:- It creates a strong bond and is highly resistant to UV light, flexible, and strong. It is widely used in quick fixes, small repairs, and crafts. | Acrylic Sealant:- It is a paintable sealant that is good for indoor use. It is applicable for molding, interior gaps, and joints. |

| Polyurethane Adhesive:- It possesses excellent moisture resistance, is highly flexible, and strong. It is widely used in applications like automotive repairs, woodworking, and construction. | Butyl Sealant:- It is a sticky sealant that forms a long-lasting bond and has high water resistance. It is widely used in applications like weatherproofing, roofing, and automotive. |

| Silicone Adhesive:- It is a rubber-like adhesive that possesses properties like flexibility, waterproofing, and temperature resistance. It is widely used in applications like construction, bonding glass, and automotive. | Polyurethane Sealant:- It is a flexible sealant applicable to various substrates. It is widely used for flooring, construction joints, and automotive applications. |

Adhesives and Sealants Market Opportunity:

What is the Opportunity for Adhesives and Sealants Market?

Growing Construction Activities Surge Demand for Adhesives & Sealants

The growing construction activities in various regions increase demand for adhesives & sealants for various applications. The rapid urbanization and growing development of infrastructure projects, residential buildings, and commercial construction increase demand for adhesives & sealants. The increasing demand for various materials like metal, plastics, wood, and concrete in construction increases the demand for adhesives for bonding. The construction applications like door sealing, window sealing, glazing, and expansion joints increase demand for sealing for air leak & water prevention, and closing gaps.

The increasing demand for insulating glass units, exterior insulation systems, and securing curtain wall panels in construction fuels the adoption of adhesives & sealants. The focus on advancements of construction, like modular & smart construction, increases demand for sealants & adhesives.

The growing development of green buildings increases demand for sealant for better water control, thermal insulation, and UV radiation. The construction applications like glazing, sanitary, flooring, insulation, kitchen, paneling, and expansion joints require adhesives & sealants. The growing construction activities create an opportunity for the adhesives & sealants market growth.

➤ Get the Full Report @ https://www.precedenceresearch.com/adhesives-and-sealants-market

Adhesives and Sealants Market Challenges and Limitations:

What is the Limitation for the Adhesives and Sealants Market?

Raw Material Price Fluctuations Limit the Expansion of the Market

Despite several advantages of the adhesives & sealants in several sectors, the raw material price fluctuations restrict the market growth. Factors like geopolitical instability, fluctuating crude oil prices, and supply chain disruptions are responsible for raw material price fluctuations. The fluctuations in the cost of raw materials like polymers, resins, and solvents directly affect the market.

The volatility in crude oil prices directly increases the production cost. Supply chain disruptions like container shortages, transportation issues, and port congestion increase the cost of raw materials. The geopolitical instability, like trade wars, political conflicts, and others, increases the cost of raw materials. The raw material price fluctuations hamper the growth of the adhesives and sealants market.

Scope of Adhesives and Sealants Market

| Report Attributes | Statistics |

| Market Size in 2024 | USD 72.33 Billion |

| Market Size in 2025 | USD 76.53 Billion |

| Market Size in 2030 | USD 101.45 Billion |

| Market Size in 2032 | USD 111.56 Billion |

| Market Size by 2034 | USD 126.5 Billion |

| Growth Rate (2025 to 2034) | CAGR of 5.75% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Become a valued research partner with us -https://www.precedenceresearch.com/schedule-meeting

Adhesives and Sealants Market Key Regional Analysis:

How Big is the Asia Pacific Adhesives and Sealants Market?

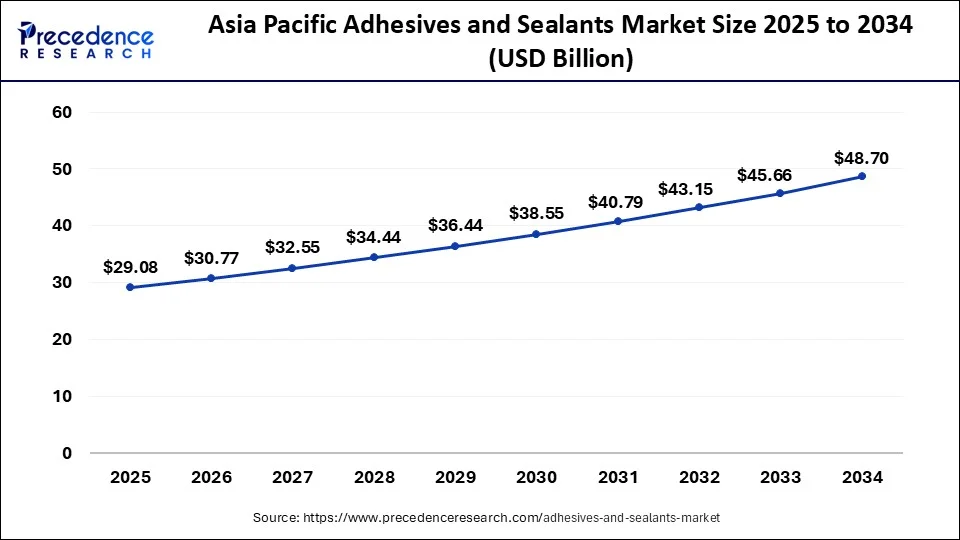

According to Precedence Research, the Asia Pacific adhesives and sealants market size is valued at USD 27.49 billion in 2024 and is anticipated to reach around USD 48.70 billion by 2034. The market is expanding at a CAGR of 5.89% from 2025 to 2034.

How Asia Pacific Dominated the Adhesives & Sealants Market?

Asia Pacific dominated the adhesives & sealants market in 2024. The rapid urbanization and growing industrialization in the region increase demand for adhesives & sealants for various applications. The growing construction activities, like commercial, infrastructure development, and residential construction, increase demand for adhesives & sealants. The growing demand for lightweight vehicle materials and the rise in electric vehicles increase the adoption of adhesives & sealants, helping the market growth.

The increasing demand for packaged food and growth in e-commerce increases the demand for packaging requires adhesives. The well-established manufacturing base across various industries, like footwear, automotive, and electronics, drives the overall growth of the market.

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

Why is Europe Significantly Growing in the Adhesives & Sealants Market?

Europe is significantly growing in the market during the forecast period. The growing investment in construction projects, like renovation and new construction, increases demand for adhesives and sealants for purposes like insulation, bonding, and sealing. The growing automotive industry and the rise in production of electric vehicles fuel demand for adhesives. The growing demand for packaging across sectors like consumer goods, food & beverage, and cosmetics helps the market growth. The stricter environmental regulations and growing demand for sustainable adhesives & sealants support the overall market growth.

Adhesives and Sealants Market Segmentation Analysis:

Adhesive Product Analysis

How PVA Segment Held the Largest Share of the Adhesives & Sealants Market?

The PVA segment held the largest share in the adhesives & sealants market in 2024. The growing applications like mortar modifications, waterproofing, and coatings in the construction industry increase demand for PVA adhesives. The increasing paper & packaging and woodworking application fuels demand for PVA adhesives. They are affordable and offer good weather resistance. It has lower VOC emissions and is biodegradable. The growing demand across sectors like concrete reinforcement, paper & packaging, and textiles drives the overall growth of the market.

The epoxy segment is experiencing the fastest growth in the market during the forecast period. The focus on bonding structural components of aircraft increases demand for epoxy adhesives. The focus on improving the aesthetics of vehicles and the development of lightweight vehicles increases the adoption of epoxy adhesives. Epoxy easily bonds with various materials like glass, plastic, metal, and wood. They are resistant to harsh chemicals and offer excellent durability & bond strength. The growing demand across the electronics and construction industries supports the overall growth of the market.

Adhesive Technology Analysis

Why did Water-Based Technology Dominate the Adhesives & Sealants Market?

The water-based technology segment dominated the adhesives & sealants market in 2024. The growing consumer preference for eco-friendly products increases demand for water-based technology. The increasing demand for a wide range of packaging applications, like cartons, labels, and tapes, fuels demand for water-based technology. The water-based adhesives provide good durability, adhesion, and flexibility. They are environmentally friendly and available in various forms like dry powders & pre-mixed solutions. The increasing demand for sustainable packaging and growth in the automotive & construction sectors drive the overall growth of the market.

The hot melt technology segment is the fastest-growing in the market during the forecast period. The growth in woodworking applications and furniture manufacturing increases demand for hot melt. The automotive applications, like electronic assemblies, interior components, and lightweight materials, increase demand for hot melts due to heat resistance and flexibility. Hot melt adhesives have strong adhesion and offer rapid setting times. They apply to diverse substrates like wood, plastics, and metals. The growth in e-commerce and the growing demand for reliable packaging support the overall growth of the market.

Application Analysis

Which Application Dominated the Adhesives & Sealants Market?

The pressure-sensitive applications segment held the largest revenue share of the adhesives & sealants market. The increasing demand for tamper-evident closures, secure seals, and labels in the food & beverage industry helps the market growth. The growing development of drug delivery systems, medical devices, and wound care increases demand for adhesives and sealants. The stricter labelling regulations in the pharmaceuticals & food & beverage industry drive the market growth.

The automotive segment is the fastest-growing in the market during the forecast period. The growing focus on using lightweight vehicle materials and reducing emissions from vehicles increases demand for adhesives & sealants. The growing production of vehicles and the development of advanced driver assistance systems in vehicles increase the adoption of adhesives & sealants. The rise in electric vehicles increases demand for adhesives & sealants for the development of sealing battery packs. The growing development of various automotive parts, like structural bonding, battery assembly, and thermal management systems, supports the market growth.

Sealant Product Analysis:

By sealant product, the polyurethane segment held the largest share in adhesive and sealants market in 2024, primarily due to its superior flexibility, durability, and strong bonding capabilities across a wide range of substrates. Polyurethane sealants are widely used in construction, automotive, and packaging applications, where resistance to weathering, moisture, and mechanical stress is essential. Their growing adoption in both residential and commercial infrastructure projects across Asia-Pacific, North America, and Europe further contributed to their market dominance in 2024.

Sealant Application Analysis:

The automotive segment held a considerable share in 2024., driven by the industry's increasing reliance on lightweight materials and advanced bonding technologies. Adhesives and sealants are extensively used in vehicle assembly for structural bonding, noise and vibration reduction, weatherproofing, and replacing traditional fasteners to reduce overall vehicle weight. With the growing production of electric vehicles (EVs) and heightened focus on fuel efficiency and performance, demand for high-performance adhesives and sealants in automotive manufacturing remained strong throughout the year.

Case Study: Adoption of Eco-Friendly Adhesives in Modular Construction – Asia Pacific Region

Company Background

GreenBuild Modular Pvt. Ltd., based in Bangalore, India, is a leading player in prefabricated housing solutions. With a focus on rapid deployment and sustainable construction, the company sought alternatives to traditional mechanical fasteners and high-VOC adhesives.

The Challenge

As GreenBuild scaled up its smart home modules, it faced:

- Extended assembly time due to mechanical joints and welding.

- Regulatory pressure to comply with green building norms (e.g., IGBC, LEED).

- Worker safety concerns related to chemical exposure from solvent-based adhesives.

The Objective

To identify an adhesive solution that:

- Offered strong, durable bonding for materials like wood, steel, and glass.

- Met environmental standards for indoor air quality (low VOC).

- Enhanced production efficiency and structural flexibility.

The Solution

GreenBuild collaborated with Sika AG and Bostik, leading adhesive manufacturers, to test and deploy:

- Silane-modified polymer (SMP) adhesives for modular panels and flooring.

- Polyurethane sealants for exterior weatherproofing and thermal insulation.

- Hot-melt adhesives for non-load-bearing joint assemblies.

These adhesives replaced welding in 60% of applications and reduced the use of rivets by 40%.

The Results

| KPI | Before Adoption | After Adoption | ||||

| Assembly Time | 3.2 hours/module | 2.1 hours/module | ||||

| VOC Emissions | 120 µg/m³ | 40 µg/m³ | ||||

| Cost/Module | $1,120 | $990 | ||||

| Customer Rework Complaints | 8% | 2.5% | ||||

- 20% reduction in total adhesive cost over 6 months

- 50% improvement in thermal insulation performance

- Achieved GreenPro certification for eco-friendly material use

Key Takeaways

- Adhesives and sealants enabled faster, cleaner, and safer construction.

- Eco-friendly products significantly enhanced brand credibility.

- Regulatory alignment drove long-term strategic value.

Industry Insight

According to Precedence Research, the Asia Pacific adhesives and sealants market is projected to reach USD 48.70 billion by 2034, with sustainable construction driving a large portion of the demand. GreenBuild's case exemplifies how real-world innovations in adhesives are transforming high-growth industries.

Discover how global companies are using innovative adhesives and sealants to improve efficiency, meet sustainability goals, and stay competitive.

Download the Full Case Study PDF@ https://www.precedenceresearch.com/sample/1141

Or speak to our analysts to understand how your business can benefit.

Email: sales@precedenceresearch.com | +1 804 441 9344

Related Topics You May Find Useful:

➢ Hot Melt Adhesives Market: The global hot melt adhesives market size accounted for USD 8.79 billion in 2024 and is expected to be worth around USD 15.74 billion by 2034, at a CAGR of 6% from 2025 to 2034.

➢ Aerospace Adhesives and Sealants Market: The global aerospace adhesives and sealants market size accounted for USD 1.12 billion in 2024 and is predicted to reach around USD 2.03 billion by 2034, growing at a CAGR of 6.03% from 2024 to 2034.

➢ High Performance Adhesives Market: The global high performance adhesives market size was estimated at USD 37.33 billion in 2024 and is predicted to increase from USD 39.20 billion in 2025 to approximately USD 60.81 billion by 2034, expanding at a CAGR of 5.00% from 2025 to 2034.

➢ Industrial Adhesives Market: The global industrial adhesives market size accounted for USD 67.65 billion in 2024 and is expected to be worth around USD 142.93 billion by 2034, at a CAGR of 7.7% from 2025 to 2034.

➢ Flooring Adhesive Market: The global flooring adhesive market size was calculated at USD 5.67 billion in 2024 and is predicted to reach around USD 13.87 billion by 2034, expanding at a CAGR of 9.36% from 2025 to 2034.

➢ Solvents Market: The global solvents market size accounted for USD 30.30 billion in 2024 and is expected to exceed around USD 60.84 billion by 2034, growing at a CAGR of 7.22% from 2025 to 2034.

➢ Epoxy Resin Market: The global epoxy resin market size accounted for USD 11.58 billion in 2024 and is predicted to increase from USD 12.33 billion in 2025 to approximately USD 20.31 billion by 2034, expanding at a CAGR of 5.71% from 2025 to 2034.

➢ Contact Adhesives Market: The global contact adhesives market size was calculated at USD 3.01 billion in 2024 and is predicted to increase from USD 3.19 billion in 2025 to approximately USD 5.32 billion by 2034, expanding at a CAGR of 5.86% from 2025 to 2034.

Adhesives and Sealants Market Top Companies:

These top companies dominate the adhesives and sealants market, holding a significant share and influencing global trends.

- H. B. Fuller Company

- 3M Company

- Avery Dennison Corporation

- Dow Chemical Company

- Bostik SA

- BASF AG

- Uniseal Inc

- ND Industries Inc.

- Beardow & Adams Adhesives Inc.

- Ashland Inc.

- Momentive Specialty Chemicals Inc.

- Eastman Chemical Company

- Sika AG

Recent Market Trends & Innovations:

- Growing demand for bio-based adhesives in sustainable packaging.

- Rise of hybrid sealant technologies for modular construction.

- Increasing use of smart adhesives in wearable medical devices.

- Surge in demand for EV adhesives for battery module assembly.

Competitive Strategy Comparison Table

| Company | Focus Area | Notable Strategy |

| 3M | Sustainability | Launch of bio-based, low-VOC adhesives |

| Bostik | Packaging | Kizen Lime eco-friendly packaging adhesive |

| Sika | Industrial Sealants | Silos/tanks sealant with high acid resistance |

| DuPont | Construction | Expanding Great Stuff spray foam for insulation |

Recent Developments:

- In September 2024, DuPont launched Great Stuff wide spray foam sealant. The sealant is applicable for joints, irregular surfaces, air sealing seams, large gaps, and hard-to-reach spaces. The Great Stuff adheres to metal, glass, plastics, wood, & masonry and is suitable for exterior & interior use. (Source: https://www.prnewswire.com)

- In September 2024, Bostik launched Kizen Lime packaging adhesives. It is made for cardboard packing and recyclable paper and is free from water & solvent. It is made up of 80% renewable ingredients and offers high performance in energy savings, mileage, and adhesion. It offers advanced safety standards and reduces carbon footprint. (Source: https://www.arkema.com)

- In September 2024, Sika launched Sikaflex-403 sealant for silos and tanks. It offers good resistance to organic acids and withstands temperatures up to 65 0C. It offers robust, enhanced performance and is suitable for industries like organic waste processing, agriculture, and food. (Source: https://www.constructionenquirer.com)

Adhesives and Sealants Market Segments Covered in the Report

By Adhesives Product

- PVA

- Epoxy

- Acrylic

- Styrenic block

- Polyurethanes

- EVA

- Others

By Adhesives Technology

- Solvent-based

- Water-based

- Hot melt

- Reactive & Other

By Adhesives Application

- Packaging

- Pressure Sensitive Applications

- Furniture

- Construction

- Footwear

- Automotive

- Others

By Sealants Product

- Polyurethane [PU]

- Silicone

- Acrylic

- Polyvinyl Acetate [PVA]

- Others

By Sealants Application

- Automotive

- Construction

- Assembly

- Packaging

- Consumers

- Pressure Sensitive Tapes

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1141

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.