Chemical Decarbonization Market Size to Worth 350.13 million tons by 2035

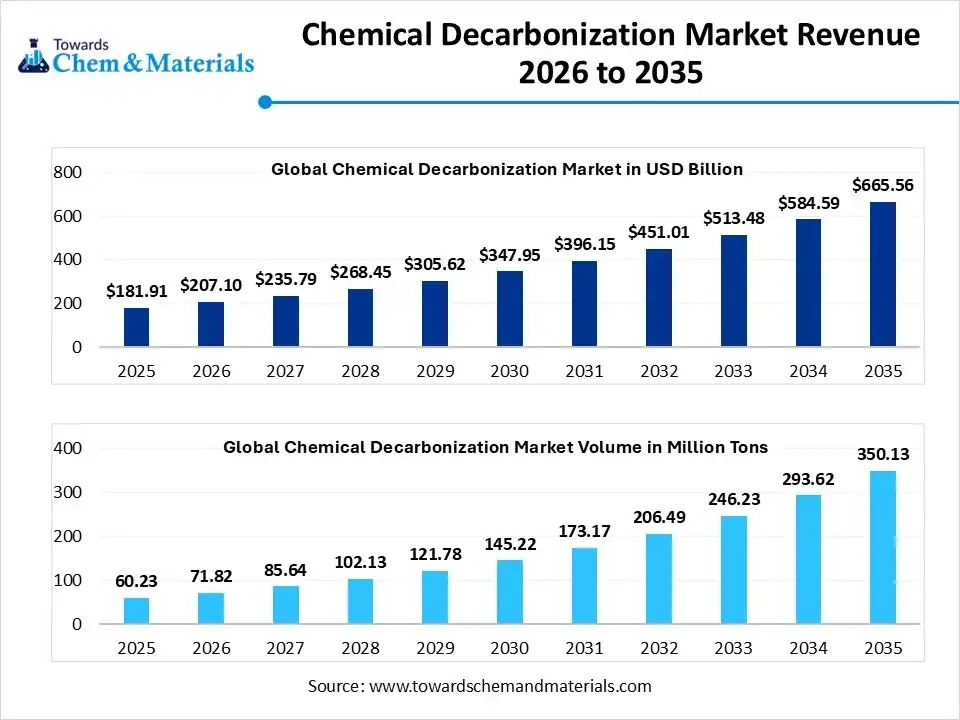

According to Towards Chemical and Materials, the global chemical decarbonization market volume was valued at 71.82 million tons in 2026 to 350.13 million tons by 2035. exhibiting at a compound annual growth rate (CAGR) of 19.25% over the forecast period 2026 to 2035.

Ottawa, Jan. 19, 2026 (GLOBE NEWSWIRE) -- The global chemical decarbonization market size was estimated at USD 181.91 billion in 2025 and is expected to increase from USD 207.10 billion in 2026 to USD 665.56 billion by 2035, growing at a CAGR of 13.85%. In terms of volume, the market is projected to grow from 71.82 million tons in 2026 to 350.13 million tons by 2035. exhibiting at a compound annual growth rate (CAGR) of 19.25% over the forecast period 2026 to 2035. The Asia Pacific dominated chemical decarbonization market with the largest volume share of 42.13% in 2025. The market is driven by tightening environmental regulations, corporate net-zero commitments, and rising demand for sustainable polymers in the application area. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6131

What is Chemical Decarbonization?

The chemical decarbonization market is characterized by a shift from carbon storage to carbon assetization, where captured emissions are converted into high-value synthetic fuels and polymers by using green hydrogen integration. Additionally, the industrial electrification and AI-driven process optimization provide the granular data needed for mandatory carbon reporting to fulfill corporate sustainability goals and a low-carbon future.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Chemical Decarbonization Market Report Highlights

- Asia Pacific dominated the global chemical decarbonization market with the largest volume share of 42.13% in 2025.

- The chemical decarbonization market in Europe is expected to grow at a substantial CAGR of 23.13% from 2026 to 2035.

- By technology, the Carbon Capture, Utilization, and Storage (CCUS) segment dominated the market and accounted for the largest volume share of 37% in 2025.

- By technology, the electrification technologies segment is expected to grow at the fastest CAGR of 24.37% from 2026 to 2035 in terms of volume.

- By feedstock, the bio-based feedstocks segment led the market with the largest revenue volume share of 64% in 2025.

- By product group, the ammonia and fertilizers segment dominated the market and accounted for the largest volume share of 37% in 2025.

Chemical Decarbonization Market Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 207.10 Billion / 71.82 million tons |

| Revenue Forecast in 2035 | USD 665.56 Billion / 350.13 million tons |

| Growth rate | CAGR 13.85% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Quantitative units | Value (Billion / Million), Volume (Million tons) |

| Segment scope | By Technology Type, By Feedstock Origin, By Target Product Group By Regional |

| Key companies profiled | Carbon Clean, Aker Carbon Capture, LanzaTech, Twelve, Dioxide Materials, Monolith Inc., Nextchem, ANDRITZ, Siemens Energy, Topsoe, Terradot, Carbon Engineering and others. |

| Country scope | U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

| Key companies profiled | Deloitte, IBM, Atos SE, Accenture, Siemens, EcoAct, SAP SE, GE DIGITAL, Dakota Software., EnergyCap, Isometrix, Trinity Consultants |

Major Government Initiatives for Chemical Decarbonization:

- EU Chemicals Strategy for Sustainability (CSS): This European Green Deal initiative aims to phase out the most harmful substances and drive innovation toward "safe-and-sustainable-by-design" chemicals.

- US Industrial Decarbonization Roadmap: The US Department of Energy established a strategic plan focusing on four pillars: energy efficiency, industrial electrification, low-carbon fuels/feedstocks, and carbon capture.

- India’s Carbon Credit Trading Scheme (CCTS): Scheduled for a full launch by mid-2026, this market-based mechanism sets mandatory emission intensity targets for energy-intensive "hard-to-abate" sectors like chlor-alkali and petrochemicals.

- China's "1+N" Policy System: This comprehensive framework provides a master plan for carbon peaking and neutrality, mandating specific energy-saving and CO2 reduction targets for the petrochemical and chemical industries.

- EU Carbon Border Adjustment Mechanism (CBAM): This policy imposes a carbon price on imports of certain carbon-intensive goods, including chemicals, to prevent "carbon leakage" and level the playing field for greener domestic production.

- US Industrial Demonstrations Program: Backed by the Bipartisan Infrastructure Law and Inflation Reduction Act, this program allocates billions in grants for first-of-a-kind commercial-scale projects to decarbonize chemical manufacturing.

- India’s BioE3 Policy: The BioE3 (Biotechnology for Economy, Environment and Employment) policy fosters biomanufacturing to shift the chemical industry from fossil fuels to sustainable, bio-based feedstocks.

- Japan’s 2050 Carbon Neutral Green Growth Strategy: This initiative provides financial and R&D support for breakthrough technologies in the chemical sector, such as using hydrogen and synthetic methane to replace traditional fossil fuels.

What Are the Major Trends in the Chemical Decarbonization Market?

- Circular Feedstock Innovation: The rising use of second-generation biomass as feedstock and plastic waste as raw material to shift away from volatile petroleum markets and investment in circular feedstock.

- Green Hydrogen Scaling: The key shift towards industrial-scale electrolysis to replace fossil-based hydrogen, focusing on the decarbonization of ammonia and methanol production to lower environmental impact.

- Stringent Climate regulations: This trend shapes the market, with a focus on reducing greenhouse gas emissions and promoting carbon capture and energy efficiency. The availability of sufficient renewable energy is influencing the market.

- Carbon Assetization: The transition from simple storage to Carbon-to-X technologies, where captured CO2 is utilized as feedstock for synthetic fuels, polymers, and green chemicals.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6131

Chemical Decarbonization Market Dynamics

Driver

The most significant market driver is regulatory mandates. The regulatory pressure forces chemical manufacturers to adopt a policy-driven shift to prioritize decarbonization, that reinforced by substantial investments. The key driver enabling industrial transformation that necessary for both legal compliance and long-term financial viability.

Restraint

What are the Primary Restraints in the Chemical Decarbonization Industry?

The high initial capital expenditure with green premium coast and infrastructure gaps restrains the market transition. The sustainable feedstocks and green hydrogen show a higher price than fossil fuel alternatives. Additionally, the lack of large-scale CO2 transport pipelines and insufficient renewable energy grid capacity prevent the adoption of decarbonization technologies.

Market Opportunity

How does Emerging Opportunity Impact Market Expansion?

Speciality Chemical Electrosynthesis is an emerging opportunity that exists in electrochemical production, focusing on commodity chemicals that allow selective reaction at lower temperatures and reduced energy intensity. The rising demand in the application sector and shift towards sustainability are driving the market opportunity.

Driving the Future: Technological Innovations Powering the Decarbonization in the Global Chemical Industry

The AI-driven shift toward digital twin optimizes energy-intensive reactions in real time and reduces operational waste. The predictive R&D accelerates the discovery of sustainable polymers and low-energy catalysts to lower carbon emissions. The next-generation electrochemical cells convert captured CO2 directly into valuable chemicals. A major shift towards plasma reactors and electric furnaces replaces fossil fuel with renewable electricity.

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6131

Chemical Decarbonization Market Segmentation Insights

By Technology Insights

Why did the CCUS Segment dominate the Chemical Decarbonization Market?

The carbon capture, utilization, and storage (CCUS) segment dominated with the largest market in 2025, because it addresses process-related emissions inherent to chemical production. It allows manufacturers to retrofit existing infrastructure, avoiding large capital losses. It turns captured CO2 into valuable feedstocks for green fertilizers, synthetic fuels, and sustainable polymers, supporting the transition towards a circular carbon economy. Rising carbon prices and regulations ensure CCUS remains vital for industrial sustainability.

The electrification segment is anticipated to grow fastest, driven by the ability of electric heating and electrochemical reactors to replace fossil fuel-based processes with renewable-powered systems. They offer better efficiency and product quality by providing a direct pathway for chemical manufacturers to align with net-zero mandates and reduce carbon footprint. Technologies like Power-to-X also support a transition to a circular and sustainable industrial economy.

By Feedstock Insights

Why Did the Bio-Based Feedstocks Segment Dominate the Chemical Decarbonization Market In 2025?

The bio-based feedstocks segment led the market by offering a direct replacement for fossil-derived raw materials. This leadership is rooted in the drop-in nature of biobased chemicals, which allows manufacturers to integrate renewable carbon from agricultural residues and biomass. Using renewable biomass lowers lifecycle emissions and aligns with consumer demand for sustainable packaging. Its established supply chain and technology ensure it remains key to carbon emission reductions.

The CO2-derived feedstocks segment is expected to experience the fastest growth in the market. This growth is driven by the need to convert captured carbon emissions into high-value assets like synthetic fuels, chemicals, and polymers, transforming waste into a sustainable resource. Supportive factors include stricter environmental laws and carbon pricing, such as the EU Carbon Border Adjustment Mechanism (CBAM), making fossil feedstocks less viable.

By Product Group Insights

How did the Ammonia and Fertilizers Segment dominate the Chemical Decarbonization Market in 2025?

The ammonia and fertilizers segment dominated the market due to its role in food security and high energy use. The primary focus of transitioning to low-carbon methods like green hydrogen reduce its carbon footprint, essential for sustainable agriculture and broader chemical industry decarbonization. By transforming traditional ammonia production into low-carbon pathways, this segment offers an impactful opportunity for industrial-scale emission reductions.

The methanol and derivatives segment is projected to experience the fastest growth in the market during the forecast period, driven by a shift to e-methanol and renewable methanol, using captured CO2 and green hydrogen to replace fossil-based production methods. The maritime sector's move to carbon-neutral shipping fuels and the chemical industry's use of Methanol-to-Olefins technology for sustainable plastics are accelerating growth.

Regional Insights

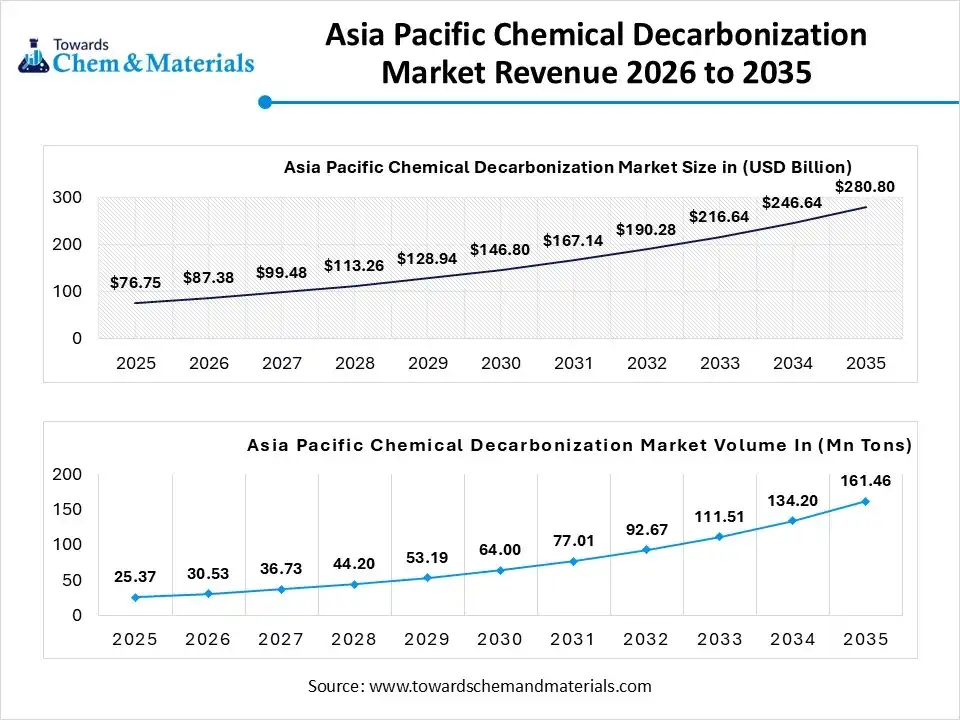

The Asia Pacific Chemical Decarbonization market size was valued at USD 76.75 billion in 2025 and is expected to be worth around USD 280.80 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 13.87% over the forecast period from 2026 to 2035. The Asia Pacific chemical decarbonization market volume is estimated at 25.37 million tons in 2025 and is projected to reach 161.46 million tons by 2035, growing at a CAGR of 20.33% from 2026 to 2035.

Asia Pacific region dominates the market as the world's primary manufacturing hub due to its vast industrial base, robust economic growth, and increasing demand for advanced solutions driven by stringent regulations and net-zero carbon emission commitments. It leads in clean technologies, mainly renewable energy systems and energy storage, supporting the transition in the chemical sector.

The region's substantial investments in green chemistry and advanced capture technology make environmental action both a regulatory requirement and an economic advantage in the domestic market.

India Chemical Decarbonization Market Trends

India's market is gaining momentum as industries adopt low-carbon technologies to reduce greenhouse gas emissions in line with national climate goals and regulatory expectations. There is growing investment in energy efficiency improvements, electrification of heat processes, and renewable energy integration across chemical manufacturing facilities to green hydrogen, carbon capture and utilization (CCU), and bio-based feedstocks as pathways to decarbonize high-emission processes and transition away from fossil-derived inputs.

Why is Europe the fastest-growing region in the Chemical Decarbonization Market?

Europe's market is poised for significant growth during the forecast period, driven by robust regulations and a growing culture of environmental responsibility. The policies promoting the circular economy and emissions trading systems, along with investments in green hydrogen projects and carbon capture solutions, are encouraging industries to adopt sustainable practices, especially in low-carbon production methods and technology implementation for process optimization to meet these strict environmental mandates.

Germany Chemical Decarbonization Market Trends

Germany's market is advancing quickly as the industry aligns with strict EU and national climate targets, prompting widespread adoption of low-carbon technologies and cleaner production processes. Companies are investing in energy efficiency measures, electrification of heat, and renewable energy integration to reduce carbon emissions and improve competitiveness.

Recent Developments in the Chemical Decarbonization Industry:

- In January 2026, Corteva and bp officially launched EtlasTM, which aimed to provide a reliable supply of feedstock, a joint venture that focuses on producing and delivering biofuel feedstocks. These services are enabling the global market to meet growing demand for low-carbon industry energy.

More Insights in Towards Chemical and Materials:

Standard Modulus Carbon Fiber Market Size to Hit USD 7.56 Bn by 2035

Propylene Carbonate Market Size to Hit USD 782.56 Million by 2035

North America Calcium Carbonate Market Size to Hit USD 25.52 Bn by 2035

Carbon Capture Utilization Chemicals Market Size to Hit USD 527.01 Bn by 2035

Advanced Carbon Materials Market Size to Hit USD 86.27 Bn by 2035

Low-Carbon Construction Material Market Size to Hit USD 601.63 Bn by 2034

Carbon Black Market Size to Surpass USD 44.77 Billion by 2034

Carbon Fiber Reinforced Plastic (CFRP) Market Size to Surge USD 48.08 Bn by 2034

Carbon Steel Market Size to Surpass USD 1,802.47 Billion by 2035

Bio-based Polycarbonate Market Size to Reach USD 80.97 Million in 2025

Specialty Carbon Black Market Size to Reach USD 8.54 Billion by 2034

Sodium Carbonate Market Size to Hit USD 16.84 Billion by 2034

Carbon Dioxide Removal Market Size to Reach USD 2,864.36 Million by 2034

Carbon Disulfide Market Size to Reach Around USD 154.15 Mn in 2025

Petrochemical Recycling Market Size to Hit USD 53.08 Billion by 2035

Chemical Recycling of Plastics Market Size to Hit USD 47.60 Bn by 2035

U.S. Chemical Distribution Market Size to Surpass USD 60.16 Bn by 2035

Chemicals Industry Market Size to Surpass USD 1,413.51 Bn by 2035

Chemical Informatics Market Size to Hit USD 20.94 Billion by 2035

Top Companies in the Chemical Decarbonization Market & Their Offerings:

Tier 1:

- BASF: Operates the world’s first large-scale electric steam cracker to eliminate up to 90% of CO2 emissions from base chemical production.

- SABIC: Deploys proprietary carbon capture and purification technology to convert industrial CO2 waste into valuable chemicals like urea and methanol.

- Dow: Developing the Path2Zero complex, the world’s first net-zero emissions integrated ethylene cracker utilizing circular hydrogen and carbon capture.

- LG Chem: Transitioning to bio-based feedstocks through Korea’s first Hydrotreated Vegetable Oil (HVO) plant to produce eco-friendly plastics and aviation fuel.

- Carbon Clean: Provides modular CycloneCC technology that significantly reduces the footprint and cost of industrial carbon capture.

- Aker Carbon Capture: Markets Just Catch™, a modular, standardized carbon capture plant designed for rapid deployment in mid-sized industrial facilities.

- LanzaTech: Uses gas fermentation to recycle industrial carbon waste into sustainable ethanol, fuels, and chemical intermediates.

- Twelve: Employs CO2 electrolysis to transform water and captured CO2 into essential chemicals and sustainable jet fuel (E-Jet®).

-

Dioxide Materials: Develops CO2 electrolyzers that use renewable energy to convert carbon dioxide into high-value chemical feedstocks like carbon monoxide.

Tier 2:

- Monolith Inc.

- Nextchem

- ANDRITZ

- Siemens Energy

- Topsoe

- Terradot

- Carbon Engineering

Chemical Decarbonization Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Chemical Decarbonization Market

By Technology Type

-

Carbon Capture, Utilization, and Storage (CCUS)

- Post-combustion Capture

- Pre-combustion Capture

- Oxy-fuel Combustion

- Carbon Utilization (CO2-to-Chemicals)

-

Electrification Technologies

- Electric Steam Crackers

- Industrial Heat Pumps

- Electric Boilers and Furnaces

- Plasma-based Heating

-

Hydrogen Integration

- Green Hydrogen (Electrolysis)

- Blue Hydrogen (SMR/ATR with CCS)

-

Process Optimization

- Advanced Catalysis

- Digital Twin & AI Efficiency Systems

-

Waste Heat Recovery

By Feedstock Origin

-

Bio-based Feedstocks

- First-generation (Food-based)

- Second-generation (Lignocellulosic)

-

Circular/Recycled Feedstocks

- Pyrolysis Oil (Chemical Recycling)

- Monomer Recovery

-

CO2-derived Feedstocks

- Power-to-Methanol

-

Power-to-Olefins

By Target Product Group

-

High-Value Chemicals (HVCs)

- Ethylene

- Propylene

- Butadiene

- Benzene/Toluene/Xylenes (BTX)

- Ammonia and Fertilizers

- Methanol and Derivatives

-

Polymers and Plastics

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

-

Inorganic Chemicals

- Chlor-Alkali

-

Soda Ash

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

-

Rest of South America

Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

-

Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

-

Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6131

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.